Something changed in the American psyche after 2008. Not unlike what happened to the generation who survived The Great Depression.

In the wake of 2008’s housing market crash, many people understandably became debt averse. Helpful leaders in the financial sector coined catchy phrases and practices to guide people out of and away from debt.

Dave Ramsey says, “Debt is dumb, cash is king, and the paid-off home mortgage has taken the place of the BMW as the status symbol of choice.”

To help exert self-control, some people even put their credit cards in the freezer. Symbolically, they “freeze” their excess spending.

There is no question that many people have fallen victim to the false promises of debt. But is it true that all debt is dumb? Could it ever be wise for a church to take on debt? What might the long-term consequences be of avoiding debt?

Using debt irresponsibly can have catastrophic consequences. Avoiding debt categorically can, as well. I’ve seen it happen.

Should Churches Go into Debt?

Catalyst Construction has helped over 100 churches improve, expand, and create new spaces for corporate worship.

It’s rare for churches to not want to grow. In over 17 years of experience, we have found one surprising common factor among growing churches.

They aren’t afraid to take on responsible church debt if it means keeping and building momentum that impacts God’s Kingdom.

Sadly, we’ve also seen the opposite to be true. It’s shocking how many churches have no debt and are not growing.

This is not to say that going into church debt is a growth strategy. Far from it! But we have found an anecdotal correlation between churches growing while going into debt – strategically.

Why might this be?

Church Debt Tolerance

The Bible is clear that taking on debt should not be taken lightly.

“The rich rule over the poor, and the borrower is slave to the lender.” – Proverbs 22:7

However, the Bible is also clear that vision is essential. Faith requires risk.

“Where there is no vision, the people perish…” – Proverbs 29:18

In no place does the Bible explicitly call debt a sin. Generally, though, it warns against it. This means that engaging debt is an option that requires wisdom.

Not all debt is created equal. The reality is there is good debt and bad debt. There is a Grand Canyon-sized difference between racking up credit card debt to improve your home theater – and working with a lender to expand your building’s capacity.

Churches focused on eliminating debt is not a bad thing, it can be a healthy pursuit. However, I have seen too many times that churches push hard on the congregation to eliminate debt.

In doing so, they tend to demonize debt instead of having a robust, nuanced conversation around wise stewardship and financial planning.

When a church takes that approach, it sets itself up for even more obstacles if it comes to a time when it must take on debt to achieve the vision God gives them.

I have seen churches that have no debt get stuck and kill positive momentum. Sadly, they avoid considering a big vision that may help their school or church because they have no tolerance for debt.

Fear of debt, when left unchecked, can lead to:

- Members save their money – instead of growing in generosity

- Money is hoarded for a “rainy day” – instead of being used to serve the community

- People are hired for ministry – instead of being raised up to serve as volunteer leaders

If are being called to step into a big vision that involves a costly project, it is healthy to see money – and debt – for what they are.

Resources to be stewarded.

Wise Planning is Key When Incurring Church Debt

Most church construction projects with a significant scope will require taking on at least some debt — even if you execute a successful capital campaign.

That’s not inherently bad.

You may not have a massive amount of money sitting in the bank. But you may have positive cash flow and a healthy financial trajectory.

If that’s your situation, then it’s not foolish or sinful to access the resources borrowing money can provide.

The question is – does your church have a problem that you can solve? What capital is required to bring positive solutions to the table?

Don’t miss this.

You won’t be able to meet every need and solve every problem. But when you are compelled to move forward with a big vision, it may require stepping out in faith and strategically taking on debt.

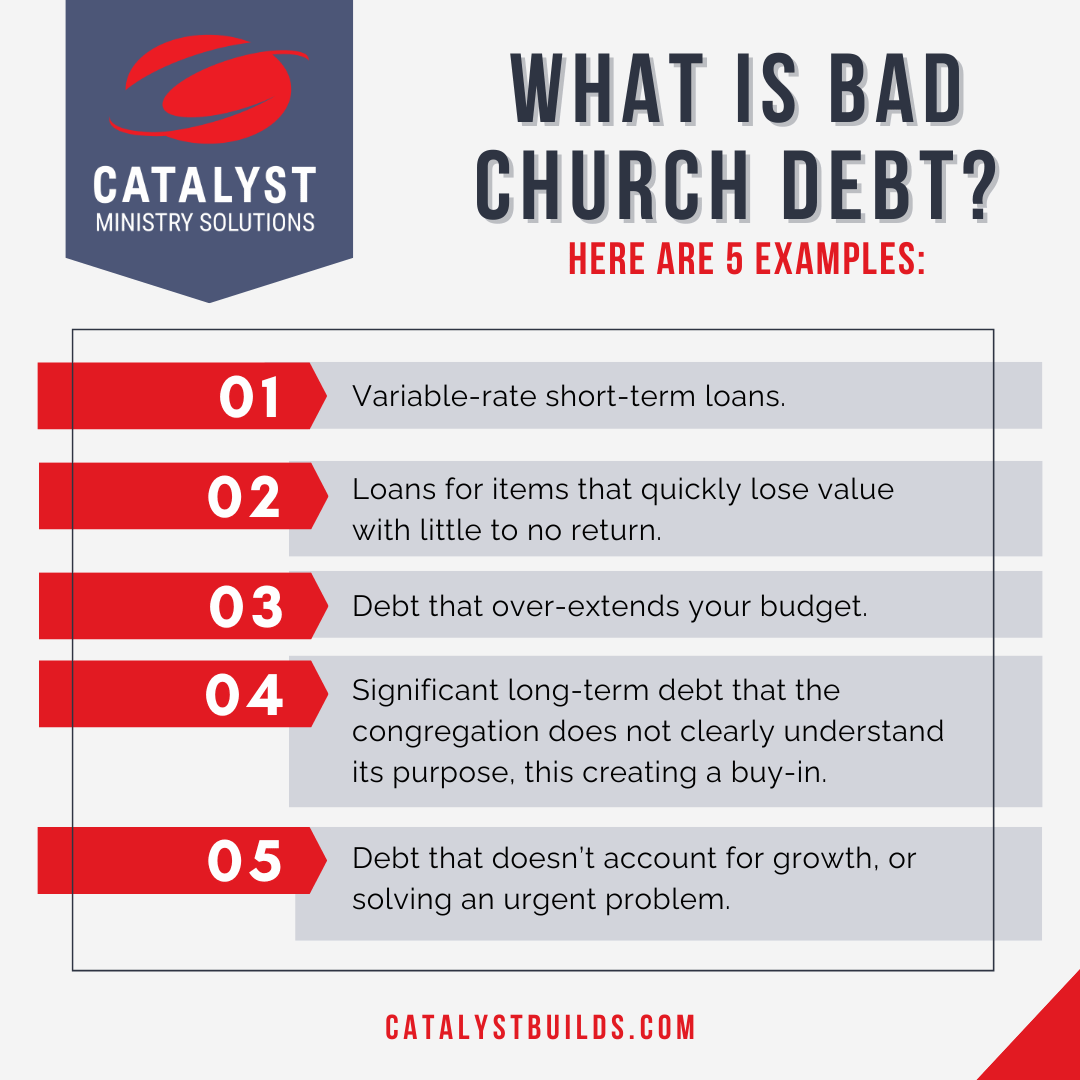

What is Bad Church Debt?

But it may not. There is bad debt. Here are a few examples:

- Variable-rate short-term loans

- Loans for items that quickly lose value with little to no return

- Debt that over-extends your budget

- Significant long-term debt that the congregation does not clearly understand its purpose, thus creating a buy-in issue.

- Debt that doesn’t account for building momentum, growth, or solving an urgent problem.

The worst financial debt, though, that a church can obtain comes from the same misguided reason that some churches have too much money in savings.

No vision.

Debt – and dollars – are only a resource. A tool. A means to an end. Money should not be demonized or glorified in any way.

Debt is at its worst when its purpose is not clear.

Same for a savings account.

When Should a Church Consider Going into Debt?

Financing is almost always necessary to complete a significant church construction project. It’s just a reality that comes with a vision worth following.

Here are a few examples of when debt can be a blessing for your church and community:

- Allows for continued discipleship and evangelism growth.

- Provides a meaningful solution to a critical issue

- Has congregational buy-in

- Is part of a long-term, strategic plan

Let’s consider each more in-depth.

Provides a Meaningful Solution to a Critical Issue

Vision is essential. But it must not be self-serving. People want to be helpful, but they need to emotionally or logically connect with the vision.

They want to contribute to something that makes a difference or solves a problem.

Has Congregational Buy-in

Does your church have a strategic communication plan? If not, you need one. Communicating regularly is critical to building consensus within your congregation.

We can help with that.

It’s difficult to overstate the power of positive momentum when a church community owns a vision for its shared future.

Is Part of a Long-Term, Strategic Plan

Be prepared, when people see a church project underway, they may check it out when it is complete.

But if you are not equipped with a healthy culture or ready to make the internal changes to accommodate the numerical growth or care for the increased spiritual needs.

The uptick in attendance may be short-lived.

Putting Church Debt to Work for You

Taking on debt, initiating a capital campaign, accessing your savings – all of these are critical decisions when considering them.

Discerning the future God may be calling you to requires due diligence in several critical areas to ensure you are heading down the right path, executing the right priorities, and next steps at the right time. You don’t have to do it alone.

We’re here to help.

From your initial dreams to your project’s completion, we can walk alongside you every step of the way. We have the expertise you need to see your vision become reality.

Don’t delay. The earlier you have us on your side, the greater access you’ll have to our extensive network of contractors, lenders, and more.

We build on purpose. It is our great honor to empower you to succeed.

Ready to get started? Reach out today for a free consultation!